cryptocurrency tax calculator australia

If you want to take advantage of the CGT discount the best option is to use a cryptocurrency tax calculator to do all the calculations for you. Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale.

Crypto Tax In Australia The Definitive 2022 Guide

Swyftx is an Australian owned and operated crypto exchange that allows users to buy Bitcoin Ethereum and 320 other crypto assets.

. Not only can we handle 400 exchanges and wallets. For it brilliant data analyzing. The CoinTracking tax calculator for Aussies.

How is crypto tax calculated in Australia. This platform directly imports data from crypto wallet merchants. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web. Total income tax will be AU5092AU8125 AU13217. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you.

June 27 2022. Coinpanda is one of the most. Sold price This is the total value in AUD.

It provides users with an extremely user-friendly app which can be. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance. Built to comply with Aussie tax standards.

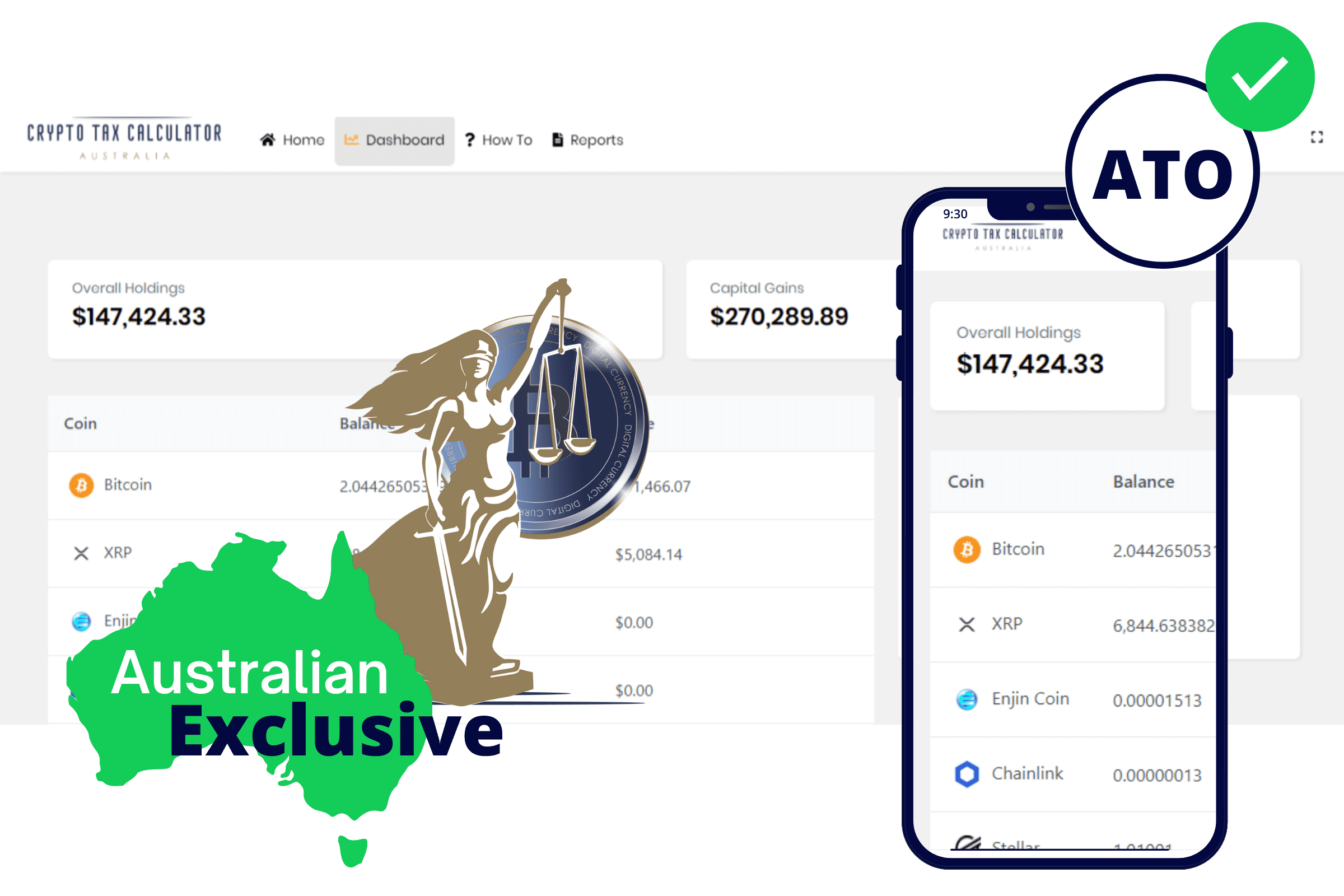

Crypto Tax Calculator Australia. This will allow CryptoTaxCalculator to produce a complete tax report for any financial year personalised to meet the Australian tax requirements. This means you can get your books.

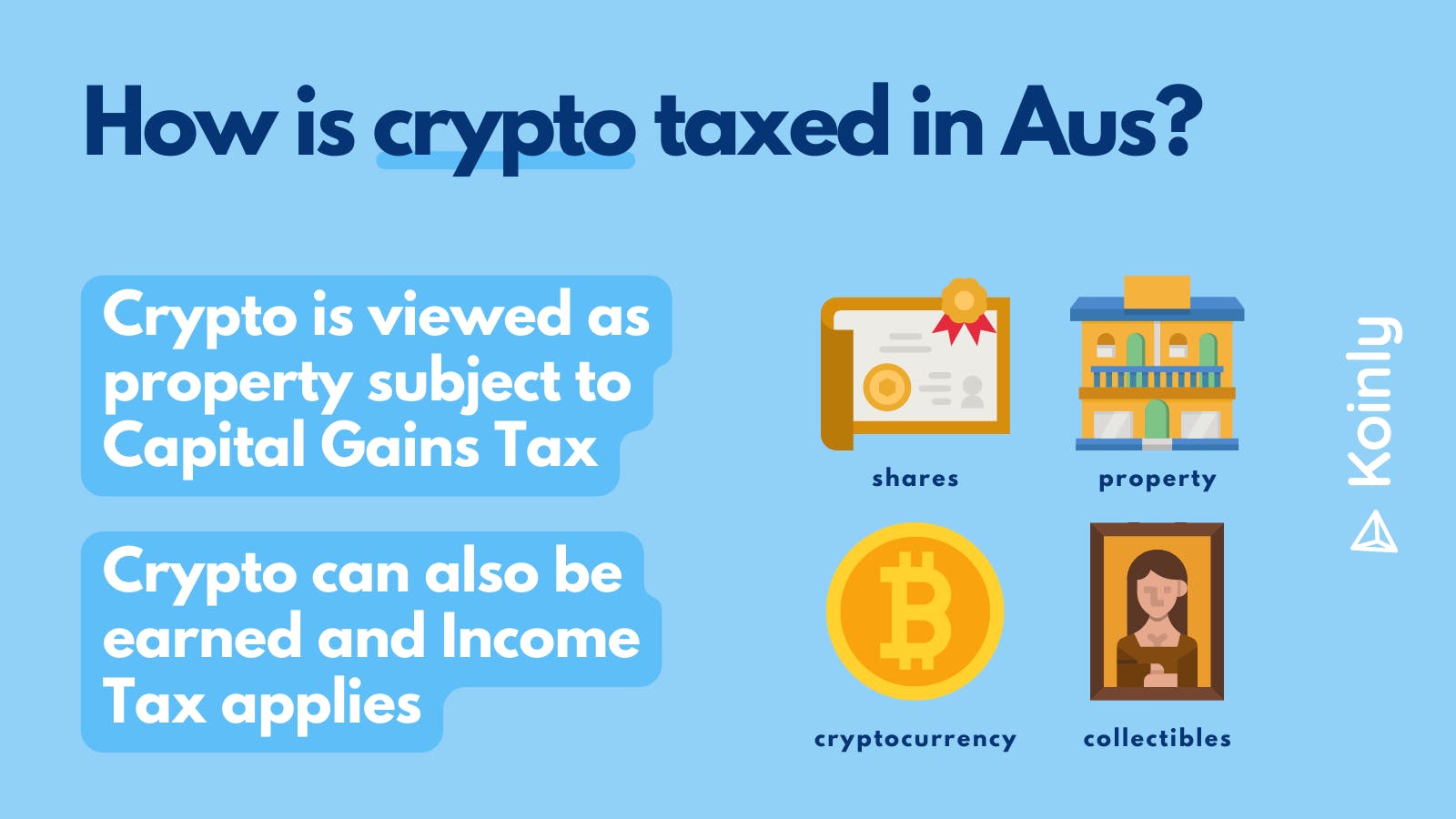

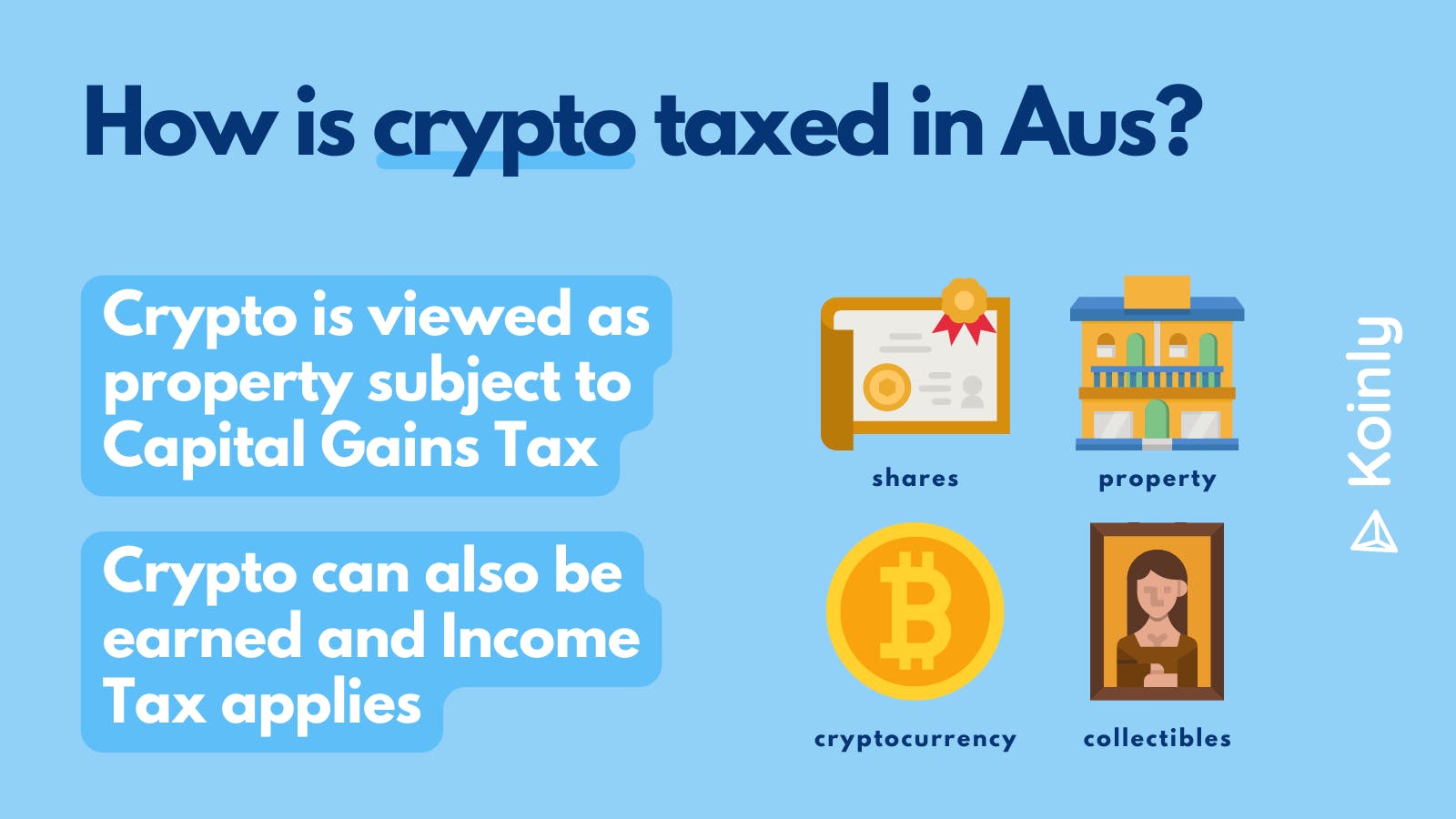

You simply import all your transaction history and export your report. CryptoTax Calculator is another great option for Australians who want to automate their crypto tax reporting. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances.

You can import data for. Crypto Tax Calculator for Australia. CryptoTaxCalculator has partnered with leading Australian cryptocurrency exchange CoinSpot offering seamless integration between the two products.

Create your free account now. Import your cryptocurrency data. Quick simple and reliable.

Backed by global liquidity Cryptocurrency. Further 2 Medicare levy tax. Cryptocurrency Tax Calculator Australia.

Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes. 5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. It takes less than a minute to sign up.

If your crypto tax situation ever gets more complex feel free to try us out at cryptotaxcalculatorio were an Aussie-made crypto tax solution. As an investor you can use either FIFO HIFO or LIFO to calculate capital gains as long as you can individually identify your cryptocurrency. Crypto cost basis method Australia.

CoinSpot Crypto Tax Guide. TokenTax is a crypto tax management company that was founded by Alex Miles back in 2017. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

Pin On Graphics Design Tutorials

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax Calculator Australia Calculate Your Crypto Tax

%20(1).png)

Coinledger Australia S 1 Crypto Tax Software

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax Calculator Australia Calculate Your Crypto Tax

Coinledger Australia S 1 Crypto Tax Software

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

![]()

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

What S The Best Penny Cryptocurrency To Invest In 2022 Cryptoshot In 2022

Guide To Crypto Taxes In Australia Updated 2022

Argentina Becomes A Partner In Binance S Investments Investing How To Become Crypto Money