richmond property tax rate 2021

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax Formerly Redlined Areas Of Richmond Are Going Green Chesapeake Bay Foundation Virginia Property Tax Calculator Smartasset Related. County Millage Rates and Fees Phone.

Vermont Property Tax Rates Nancy Jenkins Real Estate

Ultimate Richmond Real Property Tax Guide for 2021.

. The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. West Warwick taxes real property at four distinct rates. Greater Vancouver Transportation Authority TransLink 604-953-3333.

The Town of Richmonds property tax due dates are as follows. 2021 Summary Schedule of Tax Rates. We have done our best to provide links to information regarding the County and the many services it provides to its citizens.

How are residential property taxes divided. The total taxable value of Richmond real estate rose 73 percent in new tax assessment notices mailed to city property owners this week the biggest year-over-year increase in a decade. 706-821-1820 Board of Education School Millage Rates.

Richmond property tax rate 2021 Saturday May 28 2022 Edit. Tax Rate per 100 of assessed value Albemarle County 434 296-5856. What is the current tax rate.

To view previous years Millage Rates for the City of Richmond please click here. View all homes on Brookside Arbor Ln. Rhode Island Emergency Management Agency.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. Richmond Hill property tax rates are the 4th lowest property tax rates in Ontario for municipalities with a population greater than 10K. 1000 x 120 tax rate 1200 real estate tax.

City Final Tax Rate. Welcome to the official Richmond County VA Local Government Website. Property Taxes Due 2021 property tax bills were due as of November 15 2021.

Real Property residential and commercial and Personal Property. June 5 and Dec. Richmond Property Taxes Range.

Richmond property tax rate 2021 Tuesday February 15 2022 Edit. Tax rate information for property owners in Richmond Hill including how property taxes are calculated what are tax ratios and why property taxes increase. By Richmond City Council.

Property value 100000. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th. 2022 Tax Rates.

11423 Brookside Arbor Ln is a 4 Beds 3 Full Bath s property in Richmond TX 77406. 2nd And 3rd Mortgage Same Day Approval We Can Help Even If You Are Self Employed Have Little Or No Income Declare Second Mortgage Finance Loans. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

Annual Property Tax Rates 2021 Bylaw No. Payments cannot be taken at the tax commissioners tag offices. Vehicle License Tax Vehicles.

Whether you are already a resident or just considering moving to Richmond to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Macomb County Homestead Tax Rate Comparisons. Based on latest data from the US Census Bureau.

Learn all about Richmond real estate tax. Richmond Property Taxes Range. Best 5-Year Variable Mortgage Rates in Canada.

The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

30 2021 will receive a 1 discount on the tax portion of their bill a perk that is shared by only a few counties in Georgia. Amelia County 804 561-2158. Real estate taxes are due on January 14th and June 14th each year.

This information pertains to tax rates for Richmond VA and surrounding Counties. View photos map tax nearby homes for sale home values school info. View and print Information about Property Tax PDF in Richmond County.

Average Property Tax Rate in Richmond. Tax Rate 2062 - 100 assessment. The City Assessor determines the FMV of over 70000 real property parcels each year.

Municipal Finance Authority 250-383-1181 Victoria. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. 2021 Richmond Millage Rates.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Property tax payments may be paid by cheque bank draft debit card or credit card a service fee of 175 applies. Please contact Access Richmond Hill at 905-771-8949.

Property Value 100 1000. Filing deadline for tax year 2021. Understanding My Tax Bill.

4 rows Residential Property Tax Rate for Richmond from 2018 to 2021. Richmond property tax rate 2021. Monday June 13 2022.

2021 Residential Property Tax Rate. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at.

401-539-1089 Staff Directory Helpful Links. Tax Rates ALL RATES ARE PER 100 IN ASSESSED VALUE. Richmond County Property Tax Bill Breakdown.

Tax Rate 2062 - 100 assessment. 0659549 2021 Tax rates for Cities Near Richmond Hill. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

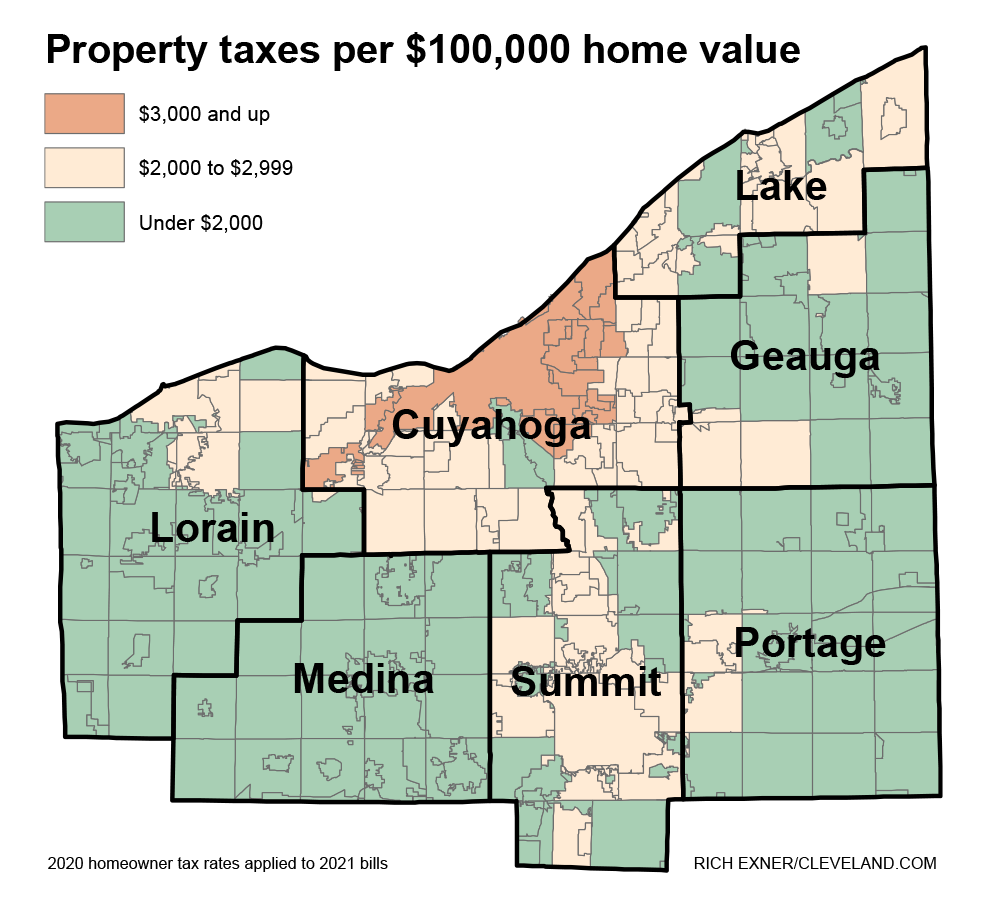

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

New York City Property Tax Rate Is It Worth Selling

About Your Tax Bill City Of Richmond Hill

Using His Luxury Horse Farm To Dodge Property Taxes Glenn Youngkin Is Sounding More And More Like His Idol Donald Trump Every Day Blue Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/KQVUCSTPZBAIHD7M7XDXG2QJTA.jpg)

Augusta S Millage Rate Unchanged But Some Homeowners Could See Property Tax Increase

Soaring Home Values Mean Higher Property Taxes

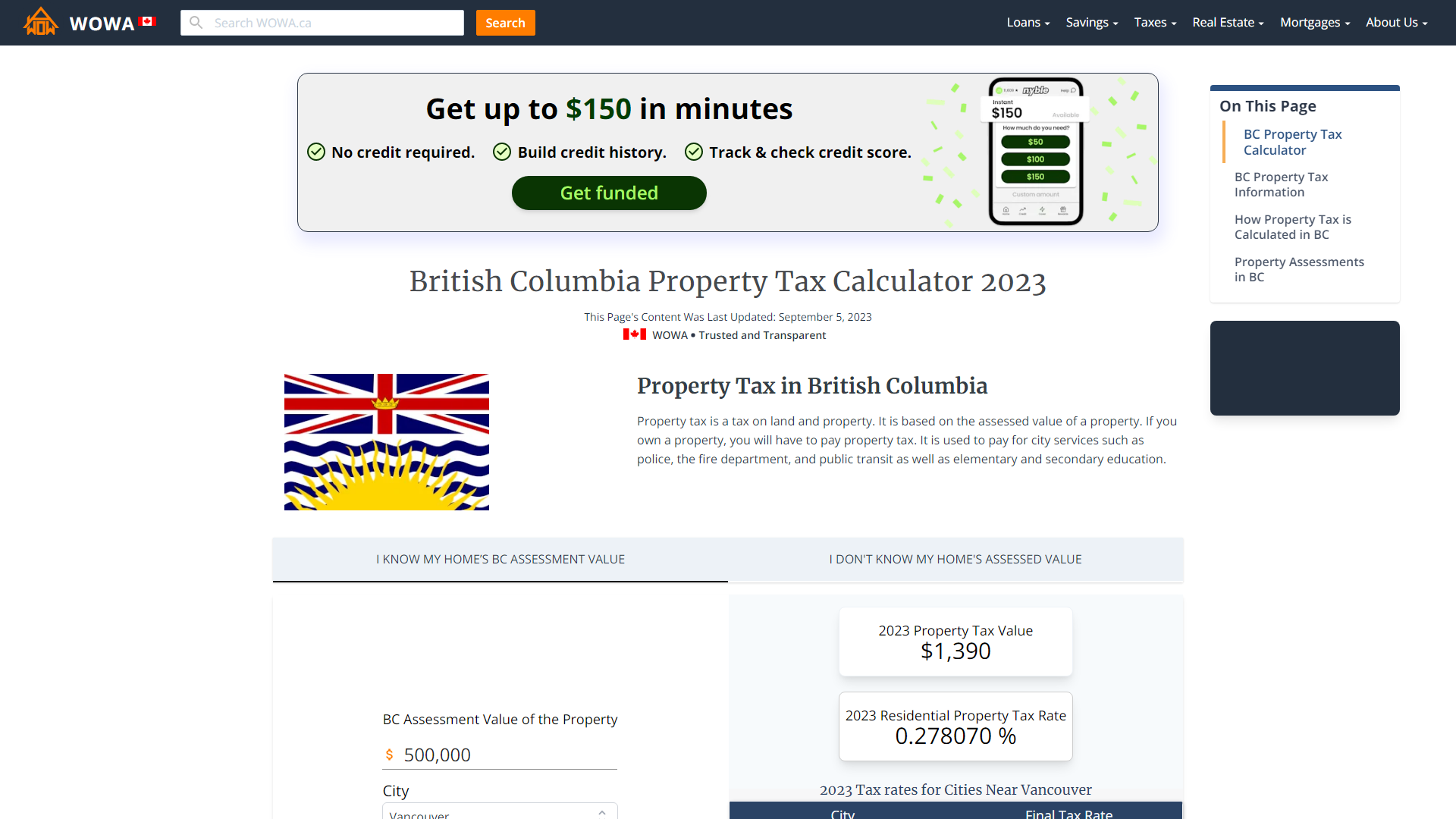

British Columbia Property Tax Rates Calculator Wowa Ca

Millage Rates Richmond County Tax Commissioners Ga

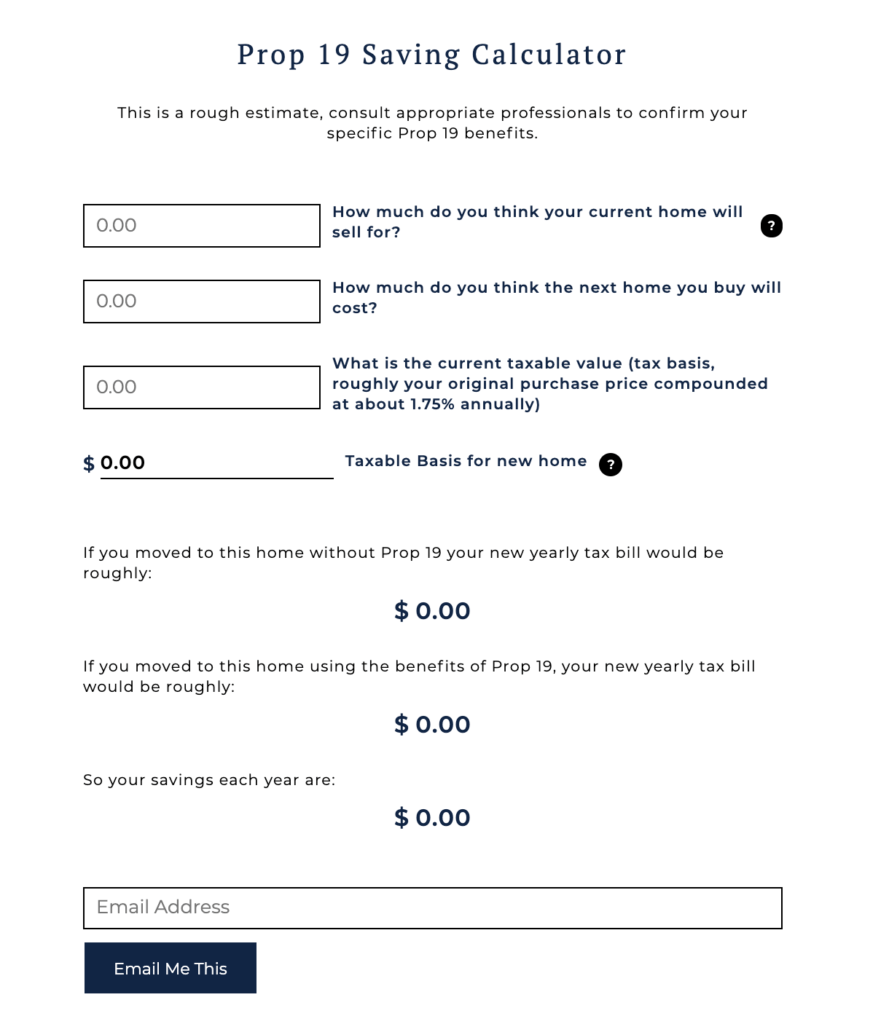

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Property Tax Rates Berkshirerealtors

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

States With Highest And Lowest Sales Tax Rates